Is the United States entering a recession?

Changing inflation starts with putting a ‘stake in the heart of the American consumer’: Business adviser

Gerald Storch, former Toys ‘R’ Us CEO and current Storch Advisors CEO responds to news that consumers are shifting to less expensive items amid inflationary pressures.

Is the U.S. economy headed for a recession, or is it already in one?

That is the big question ahead of the Commerce Department's release on Thursday of the highly anticipated second-quarter gross domestic product reading, which is expected to show that economic growth shrank 1.6% in the period from April to June.

Economic output already fell over the first three months of the year, with GDP – the broadest measure of goods and services produced in the U.S. – tumbling 1.6%, the worst performance since the spring of 2020, when the economy was still deep in the throes of the COVID-induced recession.

Recessions are technically defined by two consecutive quarters of negative economic growth and are characterized by high unemployment, low or negative GDP growth, falling income and slowing retail sales, according to the National Bureau of Economic Research (NBER), which tracks downturns.

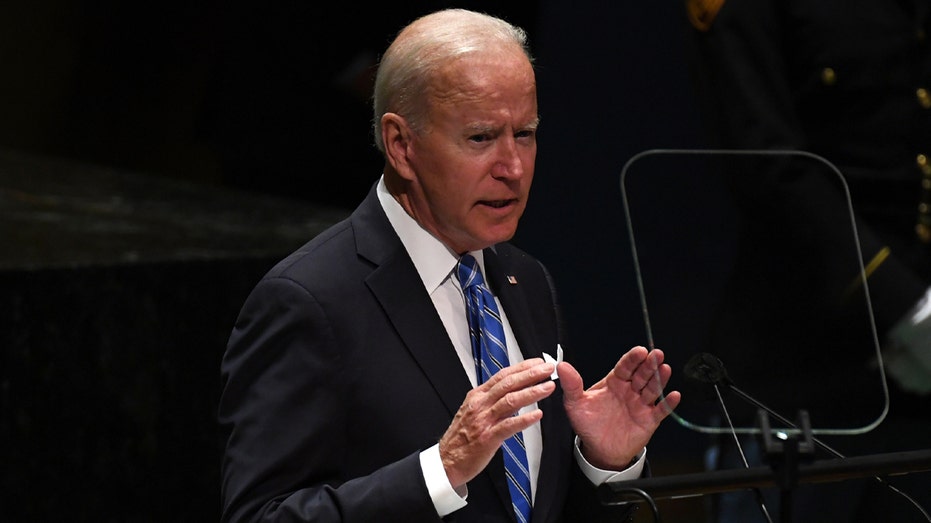

HOW HOUSING IS FUELING SEARING-HOT INFLATION

People walk outside of the New York Stock Exchange (NYSE) on July 25, 2022 in New York City. ((Photo by Spencer Platt/Getty Images) / Getty Images) If the economy declines in the second quarter, it could meet the technical criteria for a recession, which requires a "significant decline in economic activity that is spread across the economy and that lasts more than a few months." Still, the NBER — the semi-official arbiter — may not confirm it immediately as it typically waits up to a year to call it. The NBER has also stressed that it relies on more data than GDP in determining whether there's a recession such as unemployment and consumer spending, which remained strong in the first six months of the year. It also takes into consideration the depth of any decline in economic activity. "Thus real GDP could decline by relatively small amounts in two consecutive quarters without warranting the determination that a peak had occurred," the non-profit said on its website. The committee does not meet regularly, only when members decide that it is warranted. There are conflicting signs about the economy's health: The number of Americans filing for unemployment benefits has gradually increased, companies have announced layoffs or hiring freezes, and the housing market is softening. At the same time, unemployment remains near a historic low, and consumers are still spending heavily, despite scorching-hot inflation. Economists widely agree the risks of a recession climbed considerably this year and that avoiding a downturn in the near future will be increasingly difficult as the Federal Reserve tries to bring inflation under control by cooling consumer demand. Central bank policymakers raised the benchmark interest rate by 75 basis points in June for the first time since 1994 and signaled that another increase of that magnitude is possible in July. FED PREPARES ANOTHER MEGA-SIZED RATE HIKE, RISKING DEEPER DOWNTURN Hiking interest rates tend to create higher consumer and business loan rates, which slows the economy by forcing employers to cut back on spending. Mortgage rates are already approaching 6%, the highest since 2008, while some credit card issuers have ratcheted up their rates to 20%. Policymakers have remained confident that they can slow growth enough to tame inflation without dragging the economy into a recession. But Fed Chairman Jerome Powell told reporters last month that failing to restore price stability would be a "bigger mistake" than crushing growth and causing a downturn. U.S. President Joe Biden addresses the 76th Session of the U.N. General Assembly on September 21, 2021 at U.N. headquarters in New York City. ((Photo by Timothy A. Clary-Pool/Getty Images) / Getty Images) "The Federal Reserve is in a tough spot, as inflation is still raging and the economic backdrop has dramatically deteriorated since its last meeting in mid-June," said Danielle DiMartino Booth, CEO and chief strategist of Quill Intelligence and a former adviser at the Dallas Fed. "All signs point to an economy in recession. Most importantly, U.S. jobless claims have risen more than 50% since their mid-March lows surpassing a threshold associated with recession in cycles back to 1968." The White House is now trying to get ahead of what will likely be a dismal GDP report, trying to assuage voter concerns about the economy by re-framing what constitutes a recession. In a blog post last week, White House Council of Economic Advisers chair Cecilia Rouse and member Jared Bernstein argued the economy is nowhere near a downturn as defined by the NBER. CLICK HERE TO READ MORE ON FOX BUSINESS "While some maintain that two consecutive quarters of falling real GDP constitute a recession, that is neither the official definition nor the way economists evaluate the state of the business cycle," they wrote, noting that a "holistic" approach takes into account the labor market, consumer and business spending, industrial production and incomes. "Based on these data, it is unlikely that the decline in GDP in the first quarter of this year — even if followed by another GDP decline in the second quarter — indicates a recession." Source: Read Full Article