Bitcoin’s Whitepaper Anniversary: 14 Years To Transform the Exchange of Value

- It has been 14 years since Bitcoin’s whitepaper was published. The crypto community is celebrating the occasion and noting how far the asset has come.

- Bitcoin inspired the crypto market present today, with its ethos of decentralization seen in everything from DeFi to Web3.

- Bitcoin first hit $1 in 2011, crossing $67,000 only a decade later. Despite many dismissals as a fad and a bubble from those in traditional finance, it has endured.

- The asset continues to grow stronger as more institutions invest and countries adopt it as legal tender.

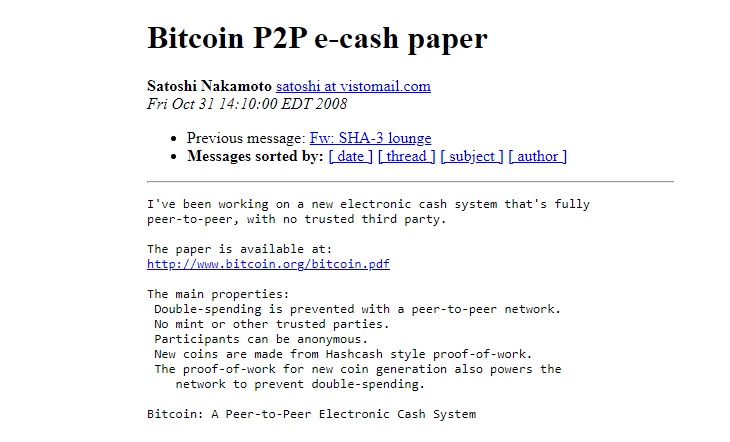

The crypto community is celebrating the 14th anniversary of the publishing of the Bitcoin whitepaper, which happened on October 31, 2008. The market’s original cryptocurrency has had an eventful life, despite being a remarkably young asset. It has gone from being the lovechild of a few cypherpunks to an investment vehicle that even the biggest institutions want — and even some countries.

Happy #bitcoin white paper day!

50% of you did not read it. Pls read it now. It makes you less vulnerable for “Faketoshis” trying to copyright/steal this open source work and for “next bitcoin” scams. Pls ask questions if you don’t understand something.https://t.co/RM0GX4K2Ha pic.twitter.com/Hao0dAkuFc

Bitcoin’s journey has been the shared experience of many. First of the ardent few who had strong convictions in the asset, and with every passing year, a growing throng of investors. As a fundamentally decentralized system, which today’s market can trace itself back to, the network is only worth as much as the individual peers who make up its network.

The first of those individuals was Satoshi Nakamoto. Perhaps it was a group of individuals, but regardless, the enigmatic entity has sparked a new wave of exchanging value, visible in everything from decentralized finance to Web3.

Satoshi’s presence still hangs over the Bitcoin market, from the cryptic newspaper headline in the genesis block to the limited number of forum posts made. The newspaper headline, which comes from The Times, refers to banks being bailed out by the British government, suggesting a displeasure in contemporary finance. It also hints that Satoshi may be British.

The whitepaper itself seems innocuous enough, perhaps even a tad too academic, to think that it would one day reach a market value of $1 trillion. Bitcoin has fallen from that peak, but the idea of a peer-to-peer currency remains strong. The whitepaper solved the difficult double-spending problem, with the rest being history.

Becoming Digital Gold

The early days of Bitcoin only had a small community of crypto enthusiasts backing it. It was not seen as a store of value or digital gold, as it is now commonly known. Hal Finney, a cypherpunk that worked closely with Satoshi on Bitcoin, was the first to receive Bitcoin from the creator. He was next after Satoshi to run a node, saying in a now-famous tweet that he was “running bitcoin.”

Running bitcoin

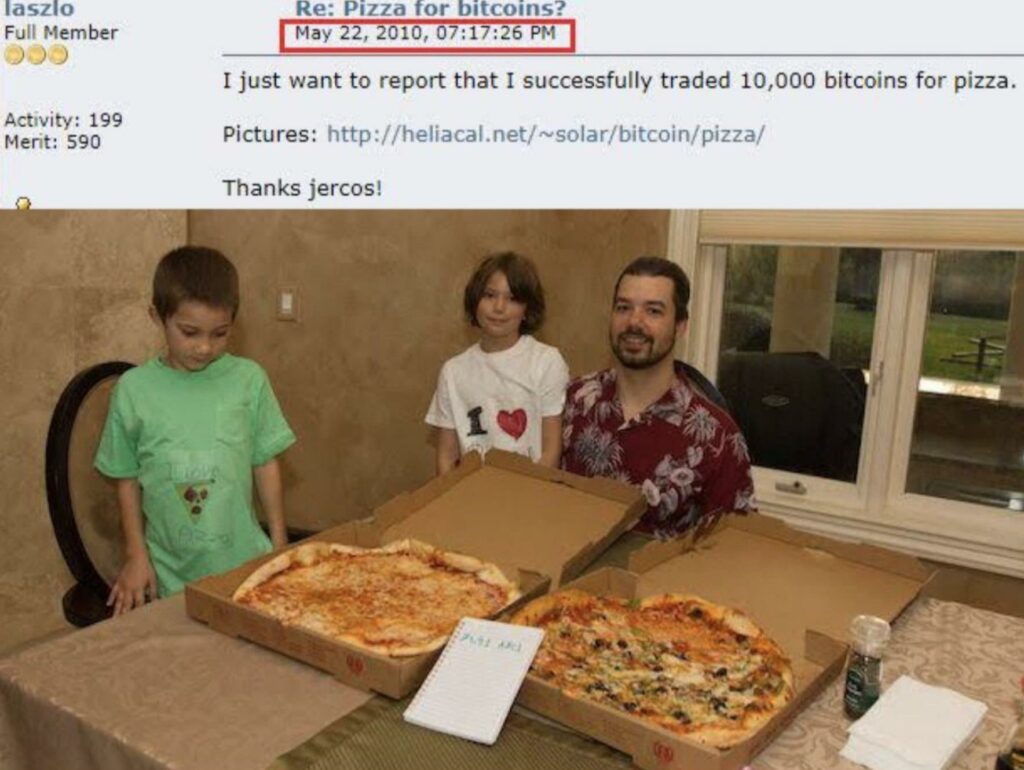

Not long after the Bitcoin network was launched, Laszlo Hanyecz made the first commercial transaction using Bitcoin. This was a more amusing circumstance that even gets its own celebration: Bitcoin Pizza Day.

Hanyecz purchased two pizzas from Papa John’s with 10,000 BTC — a sum now worth over $207 million as on October 31.

His Bitcoin forum post is also rather charming. There have been very few updates about him since the incident, but he does have a place in Bitcoin’s history.

An Experiment Turns Into a Revolution

Bitcoin’s history has consistently been marked by major milestones as it continues its inevitable march toward adoption. The asset first hit $1 in 2011 — and ten years later, cross $67,000. There have been many ups and downs in between, but Bitcoin always comes out on top.

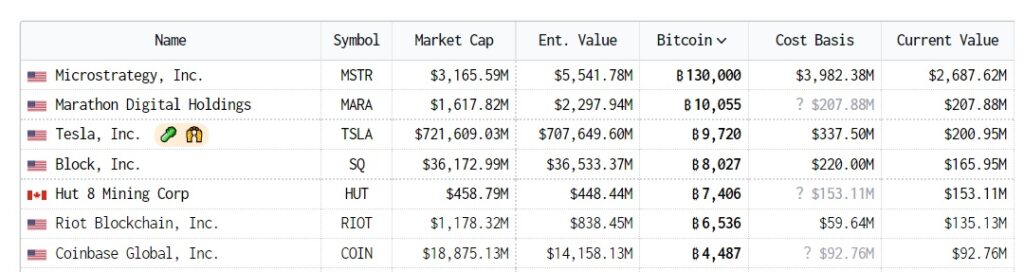

The milestones that Bitcoin has reached include attracting the likes of Square, Tesla, and MicroStrategy, all of which have invested in it. The last of those three is among the most invested in Bitcoin, though Square CEO Jack Dorsey is famously a supporter of the cryptocurrency. With such big firms entering the crypto market, it feels inevitable that the asset will only grow further.

Then there are entire countries adopting Bitcoin: most famously El Salvador making the cryptocurrency legal tender, but the Central African Republic as well. These add to the conviction that Bitcoin will be seen as an asset that stands alongside stocks and real estate.

It’s been simultaneously a long and short 14 years for Bitcoin. It shows no signs of slowing down, and as the younger, tech-savvy population takes over, there is much to look forward to.

Source: Read Full Article