Biden cancels up to $20K in student loans for Pell Grant recipients, $10K for millions of others

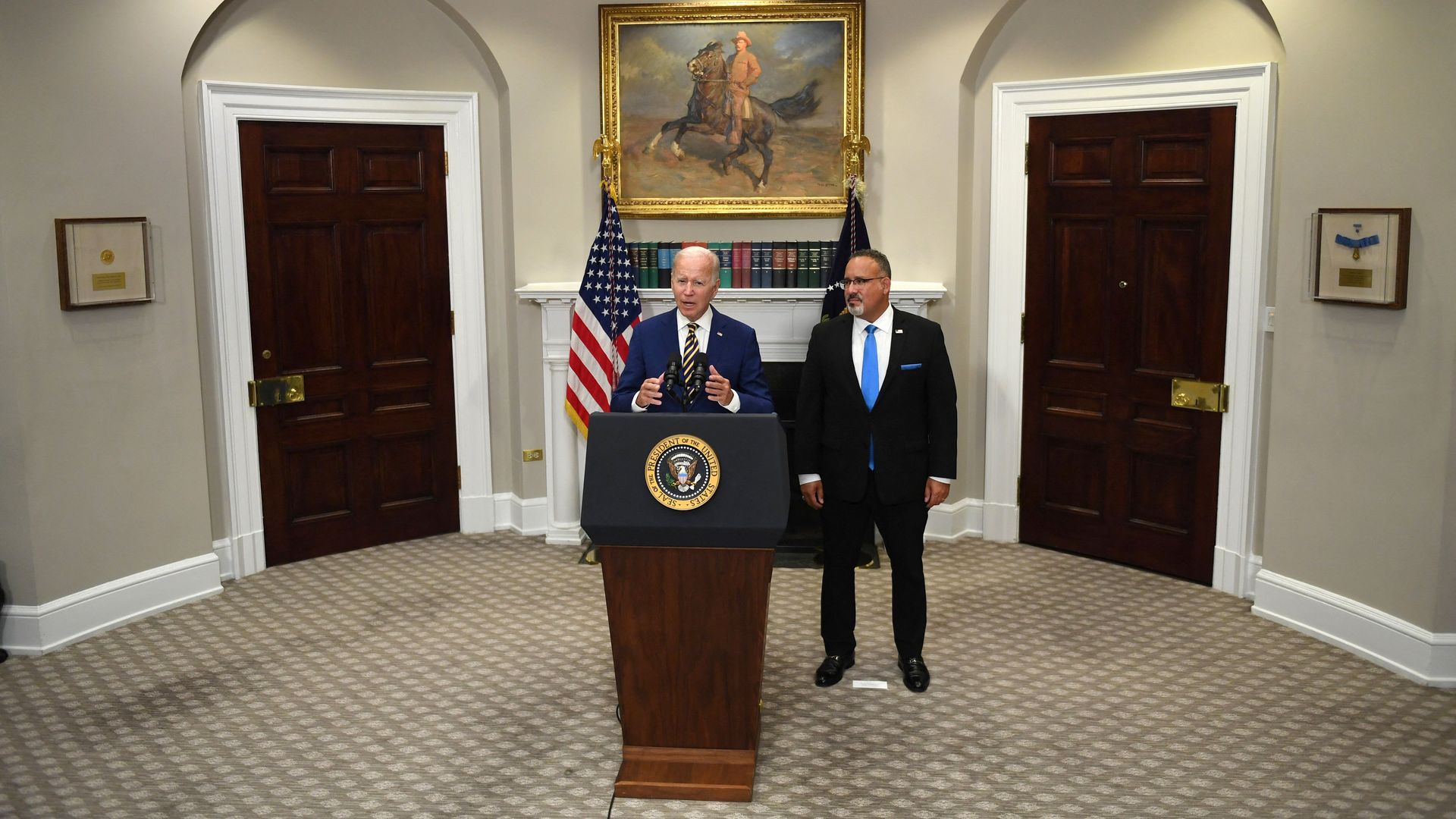

President Biden announces student loan relief with Education Secretary Miguel Cardona on August 24 in the Roosevelt Room of the White House. Photo: Olivier Douliery/AFP via Getty Images

The Biden administration is canceling up to $20,000 in student debt for Pell Grant recipients and up to $10,000 for individual borrowers who make under $125,000 per year, and it's extending the pause on repayments by four months, the White House announced on Wednesday.

Why it matters: The decision — which comes days before the Aug. 31 deadline when loan repayments were set to resume after a series of pandemic pauses — is expected to alleviate some of the debt burdens of 43 million Americans while also fulfilling a key campaign promise.

Driving the news: Approximately 20 million Americans could have their debt completely canceled under Biden's announcement.

- The debt forgiveness for Pell recipients is in addition to the cancellation of up to $10,000 in student debt for other borrowers.

- Critically, the Biden administration is taking steps to make the student loan system more manageable for future borrowers.

- It will cap monthly payments at 5% of a borrower's monthly income and forgive loan balances after 10 years of payments for borrowers with loan balances of $12,000 or less, among other measures.

- The $10,000 in debt relief also applies to households that earn $250,000 a year or less.

"All this means people can start to finally crawl out from under that mountain of debt, to get on top of their rent and utilities, to finally think about buying a home, or starting a family or starting a business," Biden said Wednesday.

- "My plan is responsible and fair. It focuses the benefit on middle class and working families. It helps both current and future borrowers, and it'll fix a badly broken system," he added.

Be smart: The issue has forced the Biden administration to balance an attempt to appeal to younger and minority voters ahead of the midterms with the risk of adding to rampant inflation, thereby giving Republicans another talking point ahead of the midterms.

What they're saying: "Even at $10,000 of debt cancellation, a substantial number of people will be out of debt and it is disproportionately beneficial to the folks who are in default on their debts," Persis Yu, policy director for the Student Borrower Protection Center, told Axios

- "Extending the pause is really critical to actually delivering on cancellation and the other programs that reform the student loan system," Yu added.

Between the lines: The Department of Education lacks income data for most Americans with student debt, so most borrowers will have to apply — a process that could be lengthy.

- "We should worry about people who are not in touch with the federal government who could fall through the cracks," said Bryce McKibben, former senior policy adviser to Sen. Patty Murray (D-Wash.) on the Senate Health, Education, Labor and Pensions Committee.

- "Folks who are really at risk of struggling with their student debt are also going to be the most at risk of not being able to fulfill the paperwork requirements," he said.

- Nearly 8 million borrowers are eligible for relief automatically, as the Department of Education already has their income data, the administration says.

The big picture: President Biden had already approved nearly $32 billion in loan discharges for Americans through a number of targeted programs for borrowers who were defrauded by their colleges, borrowers with disabilities and public servants.

- Progressive lawmakers, labor unions and civil rights groups have been pushing the Biden administration to cancel as much as $50,000 in student loan debt.

What to watch: Biden said Wednesday that the Education Department will in the coming weeks release a "short and simple" form for borrowers to apply for student loan relief.

Go deeper:

- Everything you need to know about Pell Grants

- Biden's student loan test

- Biden admin moves to fix "longstanding failures" in student loan programs

- Signs of reform for America’s student debt

- What's at stake with Biden's looming student loan announcement

Editor's note: This story had been updated with additional details throughout.

Source: Read Full Article