Ethereum Poised To Hit 35% Surge In Staking Demand

In 2022, Ethereum formally adopted Proof of Stake (PoS) as a more secure and energy-efficient method to validate transactions and add new blocks to the blockchain.

PoS and other consensus mechanisms are integral to the security of a network. This shift has significant implications for the Ethereum ecosystem, particularly in terms of staking – the process of holding funds in a cryptocurrency wallet to support the operations of a blockchain network.

Related Reading: Will Listing Of Floki Inu On Brazil’s Largest Exchange Boost Meme Coin’s Price?

While staking has been around for some time, several factors are now converging to potentially drive a significant increase in ETH staking. In fact, a leading staking service provider has predicted a surge in staking activity and has backed it up with compelling reasons.

So, what does this mean for Ethereum, and why is staking becoming such a critical part of its blockchain infrastructure?

Staked Q2 Report Predicts Significant ETH Staking Rate Increase

Staked, a research subsidiary of the Kraken exchange, has released its Q2 report, projecting that the ETH staking rate could see a significant increase of 20% to 35% over the next 12 to 18 months. This forecast was based on several factors, including the recent increase in average Ethereum staking yield from 5.2% to 5.8% on a year on year basis.

Moreover, the Staked Q2 report’s prediction of a significant increase in the ETH staking rate could also have broader implications for the cryptocurrency market as a whole. If more users begin staking their ETH, the circulating supply of the cryptocurrency will decrease, potentially leading to an increase in its price.

This, in turn, could have a ripple effect on the entire cryptocurrency market, making it a crucial trend to watch in the coming months.

ETH total market cap currently at $218 billion on the daily chart at TradingView.com

What Increased ETH Staking Means For Investors

One of the most obvious benefits is that a higher staking yield means investors can earn more rewards for their staked ETH. This could be especially appealing to long-term investors who are looking to maximize their returns.

Additionally, the increase in staking could potentially lead to a decrease in the circulating supply of ETH, which could drive up its price. This means that investors who are holding ETH could see their holdings increase in value.

But the impact of increased ETH staking goes beyond just earning rewards and potential price increases. It also has a positive effect on the overall health and stability of the Ethereum network.

By staking their ETH, investors are essentially locking it up, making it more difficult for bad actors to attack the network. This makes the network more secure and trustworthy, which could attract more users and investors to the platform.

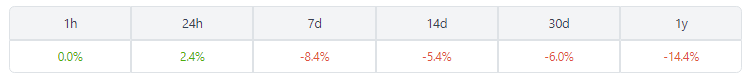

Source: Coingecko

At the time of writing, the price of ETH stands at $1,798 according to CoinGecko, with a 2.4% rally in the past 24 hours. However, it’s worth noting that ETH has experienced a seven-day slump of 8.5%, highlighting the volatility that is characteristic of the cryptocurrency market.

-Featured image from Siam Blockchain

Source: Read Full Article