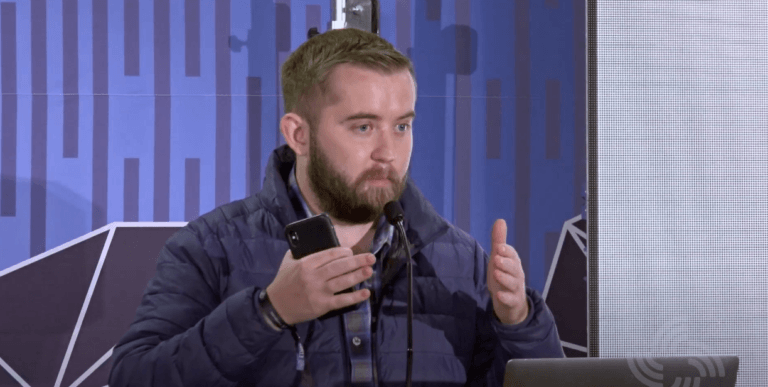

Chainlink Labs Co-Founder Sergey Nazarov on Chainlink’s Partnership With SWIFT

In a recent interview, Chainlink Labs Co-Founder Sergey Nazarov shared his latest thoughts on blockchain technology.

Nazarov’s comments were made during an appearance on an episode of YouTube series “Real Vision Crypto” that was released four days ago.

According to a report by The Daily Hodl, Nazarov had this to about blockchain interoperability:

“With the one caveat that it’s going to take time to create that security, I think this initial dynamic, I expect it to start taking hold more and more in 2023. So in the coming year, I imagine seeing more and more applications starting to become hyper-connected between chains, starting to become composed of multiple parts on different chains, partly with the help of CCIP (Cross-Chain Interoperability Protocol).

So the goal for us is to get out early versions that we end up testing with with production users for initial small subsets of use cases. And then we learn from that and the Chainlink community learns from that and then we’re able to make an increasingly secure system that can handle higher throughput, higher amounts of value, just like we’ve been able to do that with the data side.“

As for his startup’s partnership with SWIFT, the Chainlink Labs Co-Founder said:

“Now we’re working through the early stages of a second proof-of-concept with (SWIFT) and multiple banks, where we are basically looking to use CCIP to connect multiple chains in the kind of banking infrastructure world, both with public chains as well as private banking chains.

“And this is important because collateral and liquidity will live on different chains, both on public chains and on private banking chains, but just like applications would like to have access to users, collateral, liquidity, all these things on various public chains, private chains actually want the same thing between banks and they also want access to public chains.“

https://youtube.com/watch?v=aRA5HqF7cII%3Ffeature%3Doembed

The Society for Worldwide Interbank Financial Telecommunication (SWIFT), a Belgian cooperative society providing services related to the execution of financial transactions and payments between banks worldwide, has been exploring the use of blockchain technology.

On 13 September 2022, SWIFT announced that it it is working with “seven securities player” (such as American Century Investments, Citi, Vanguard and Northern Trust) on a project aimed at driving “efficiencies in communicating significant corporate events”; the project will “trial an ambitious solution powered by Symbiont’s enterprise blockchain platform.”

Here is SWIFT explaining the motivation for this project:

“When an event takes place at a publicly traded company – dividend payments, exchange offers, mergers, Dutch auctions or other corporate actions – the information needs to be quickly shared with investors, creditors and all other key stakeholders.

“Automation of these communications has improved in recent years, but it’s still heavily dependent on manual processes that create both added costs and risks for market participants.

“The problem is compounded by the number of intermediaries – central securities depositories (CSDs), local and global custodians, fund managers, paying agents, etc. – which make up the investment chain. Each has to pass on information about the event and, because they follow different data standards, may communicate about it slightly differently.

“This creates complexity for asset managers, custodians, brokers and other recipients downstream as they receive information about the same event from multiple issuers and, in some instances, with missing, contradictory or inaccurate data. They then have to manually comb through, compare and clean the data to arrive at a single accurate picture of the event so they can make relevant decisions.“

Jonathan Ehrenfeld, Strategy Director at SWIFT, stated:

“Major asset managers will have hundreds of custodian relationships, with assets and securities scattered across a wide range of counterparties. If there’s a corporate event, these asset managers and other intermediaries will receive information from all these sources, and this is where we start to see problems.

“According to our analysis, manual activities – such as data cleansing, formatting and interpretation – account for around 30% of the costs involved in processing corporate actions,” says Ehrenfeld. “That’s why we are collaborating with our community to deliver a solution that delivers accurate corporate action data to market participants in near real time.“

For this trial, SWIFT is using enterprise blockchain platform “Assembly” from Symbiont; this platform allows financial institutions to “issue, track and manage financial instruments, such as collateral, commodities, data, loans and securities.”

SWIFT says that is is trying to “further automate and increase the accuracy of the corporate action workflow” by using Assembly’s “smart contracts and blockchain capabilities” to “create a network effect that leverages the 11,000+ institutions connected to SWIFT globally.”

Tom Zschach, Chief Innovation Officer at SWIFT, had this to say about the use of Symbiont Assembly:

“By bringing Symbiont’s Assembly and smart contracts together with SWIFT’s extensive network, we’re able to automatically harmonise data from multiple sources of a corporate action event. This can lead to significant efficiencies. Corporate action data from SWIFT messages is translated by the SWIFT Translator and uploaded in Symbiont’s blockchain. Their smart contract technology can then compare information shared between participants and flag discrepancies, contradictions or inconsistencies across custodians.”

SWIFT went on to say that this solution is “currently in development with a pilot group of participants that are set to test it and provide feedback in September.”

Source: Read Full Article