Bitcoin Whales On a Buying Spree: Transactions Hit $100K Yearly High! – Coinpedia Fintech News

Bitcoin whale activity surges to new yearly high, signaling strong institutional interest.

Bitcoin price reaches $35,000, its highest level since early May 2022.

Approval of Bitcoin spot ETFs in early 2024 could propel Bitcoin’s market value to $42,000 and beyond.

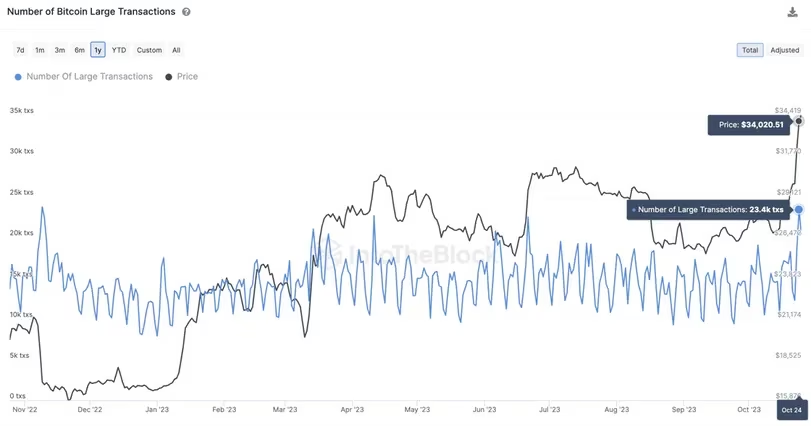

The Bitcoin blockchain has recently seen a remarkable surge in transactions, surpassing the $100,000 mark, setting a new yearly record. This surge signals significant engagement from major players, often referred to as “whales,” and influential investors in the cryptocurrency world.

Whales & Big Investors Pour Money

The rise in on-chain activities for Bitcoin underscores the active involvement of whales and influential investors as the cryptocurrency’s price rose above $35,000.

Recent data from the blockchain analysis firm IntoTheBlock reveals that the number of transactions involving the movement of at least $100,000 worth of BTC reached a yearly peak of 23,400 in the past week.

Also Read: Bitcoin Price Prediction November: Here’s How High BTC Price Will Rally!

Bitcoin’s Impressive Performance

Since last week, Bitcoin’s price reached $35,000, marking its highest level since early May 2022. Despite some sideways trading, hovering around $34,000, Bitcoin has shown a year-to-date gain of 107%, with a 27% surge this month.

In a recent newsletter, IntoTheBlock noted that the emergence of Bitcoin spot ETF applications has piqued the interest of whales and institutional investors in Bitcoin.

This increased interest in Bitcoin can be attributed to a significant increase in transactions of over $100,000, a trend that began in late June with the launch of Blackrock’s ETF and has continued as Bitcoin reaches new price heights not seen in a year. The recent surge in whale activity might be a sign of things to come in 2024.

Are ETFs Coming?

Furthermore, there is widespread anticipation that the U.S. Securities and Exchange Commission (SEC) will soon approve several spot-based exchange-traded funds (ETFs) in the early part of the coming year. Analysts believe that the introduction of BTC ETFs could propel Bitcoin’s market value to $42,000 and beyond.

Blockchain data also shows a surge in participation from retail investors in recent weeks. According to data from Deutsche Digital Assets, the on-chain activity index for small entities reached a new yearly high, hitting 1.5 last week.

Read More: Gensler’s Double Standard: Why Is He Blocking Bitcoin ETFs?

The involvement of small investors is considered a crucial factor for the sustainability of a bullish market in cryptocurrency assets.

Impact on Altcoins

In a previous Coinpedia report, it was highlighted that Pepe coin and Floki Inu broke through their monthly resistance levels, largely driven by the backing of whales and increasing profitability. These events coincided with Bitcoin’s price surging to $35,000.

On-chain data illustrates a significant increase in whale investor activity surrounding Floki Inu and Pepe coin. Both tokens experienced heightened price volatility after surpassing critical monthly resistance levels.

However, there are concerns about the potential for these investors to sell their Pepe coins and Floki Inu holdings if the prices plateau.

Source: Read Full Article