AIF commitments jumped 30% to Rs 8.33 trillion in FY23, shows data

Alternative investment funds (AIFs) — pooled investment vehicles catering to high net worth individuals (HNIs) — saw a 30 per cent increase in investment commitments during financial year 2022-23 (FY23).

At the end of March 2023, the total investment commitments raised stood at Rs 8.33 trillion, up Rs 1.92 trillion from Rs 6.41 trillion at the end of March 2022.

A commitment is the money clients are willing to put into AIFs.

These funds typically invest in unlisted companies, start-ups, early-stage ventures, real estate, and distressed assets in search of higher yields.

Meanwhile, the total investments made by the AIF industry increased 19 per cent in FY23 to Rs 3.38 trillion from Rs 2.84 trillion during FY22.

The fund raise stood at Rs 3.66 trillion at the end of March 2023.

The committed investments come in tranches from the investors to the fund managers and are reflected in the funds raised.

The largest contributor to this growth has been the Category II AIFs, which are typically private equity and debt funds with a minimum tenure of three years.

In Category II, Rs 6.93 trillion worth of investment commitments have been made while the funds raised stood at Rs 2.66 trillion by the end of last financial year.

Investment commitments in Category I and Category III stood at Rs 58,929 crore and Rs 80,899 crore, respectively.

Category I comprises venture capital funds, while Category III includes hedge funds.

Industry experts are of the opinion that transparency and investor-friendly norms by the markets regulator has strengthened the investor inclination towards AIFs, which only began mopping up assets in 2012-13.

Since then, the industry has made rapid strides.

The commitments raised by the AIF industry crossed Rs 1 trillion for the first time only in September 2017.

In less than six years, it managed to cross the Rs 8-trillion mark.

Industry players expect further increase in volumes and investments.

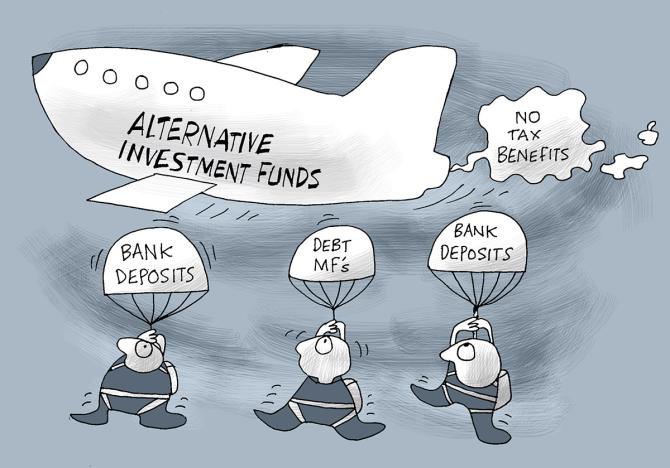

This is owing to the change in taxation on debt mutual funds (MFs).

“The post-tax return hurdle has now shifted from about 7 per cent to maybe 4-5 per cent due to changes in taxation for debt MFs.

“In this changed environment, investors are now adding to their allocations in non-equity, non-debt investments, such that it provides true diversification and improves the quality of post-tax return for the investor without substantially increasing the portfolio risk,” said Vineet Bagri, chief executive officer (CEO), Athena Investments.

“The aim of AIFs is to generate between 6 and 9 per cent on a post-tax basis,” he added.

While the AIF industry has got a boost due to the change in tax structure in debt MFs, it is also undergoing a paradigm shift as far as the regulatory turf is concerned.

Recently, the Securities and Exchange Board of India (Sebi) directed AIFs to provide an option of direct plan and charge distribution fee for other schemes only on trial basis.

The move to bar upfront commissions was aimed at reducing mis-selling.

Sebi has also tightened regulations with the introduction of valuation norms, mandatory dematerialisation of units, certification examination for key investment managers, and ‘excuse-exclude’ norms to bring more transparency.

“The segment has grown significantly as a greater number of investment managers, track record build-up with fund tenor completions and the robust nature of the regulatory oversight of AIFs has increased investor confidence,” said Ravi Vukkadala, CEO, Northern Arc Investment Managers and member of the governing council of Indian Association of Alternative Investment Funds (IAAIF).

The benchmarking norms have also made it easier for investors to gauge performance.

Earlier this month, CRISIL launched three new benchmarks for the AIF industry.

The new benchmarks include real estate funds — residential and distressed assets funds — that fall in Category II AIF, while hybrid funds are Category III AIFs.

With this, CRISIL has 10 benchmarks across the three AIF categories.

Source: Read Full Article