Bitcoin Fees Overtake Ethereum as Ordinals Drive Market Activity

Ordinals, in the context of Bitcoin, refer to a recent development that allows for the inscription of unique, non-fungible data onto individual satoshis, the smallest unit of Bitcoin. This concept transforms these satoshis into one-of-a-kind digital artifacts akin to non-fungible tokens (NFTs) on other blockchain platforms. Each satoshi can be inscribed with content such as images, text, or other data, making it uniquely identifiable and collectible.

This development is significant because it brings a new dimension to the Bitcoin ecosystem, traditionally focused on financial transactions. By enabling satoshis to carry unique information, ordinals create opportunities for art, collectibles, and other forms of digital expression within the Bitcoin network. However, it’s important to note that, unlike traditional NFTs on Ethereum or similar platforms, these inscriptions are not managed by a smart contract but are instead embedded directly into the Bitcoin blockchain.

The implementation of ordinals has sparked debates within the Bitcoin community regarding the impact on block space, transaction fees, and the broader implications for Bitcoin’s identity as a primarily financial tool.

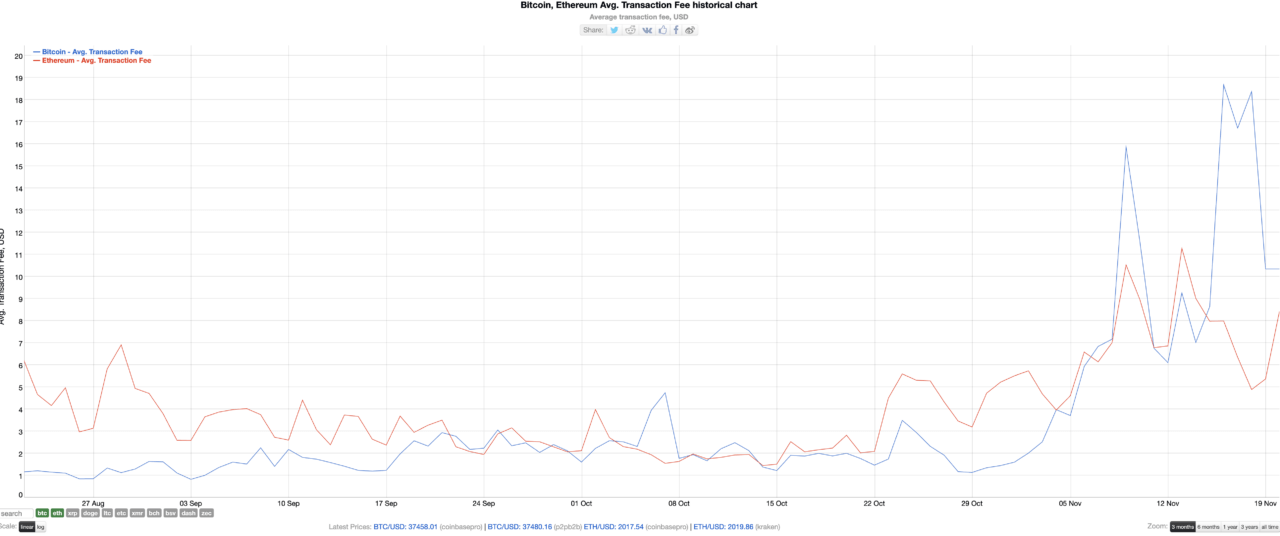

In a notable shift in the cryptocurrency landscape, Bitcoin’s average daily transaction fees have recently surpassed those of Ethereum. This development has been attributed to the increased activity surrounding Ordinals on the Bitcoin network.

As of November 20, Bitcoin’s average daily transaction fee was recorded at $10.34, overtaking Ethereum’s fee, which averaged at $8.43. This data, sourced from BitInfoChart, marks a significant change in the fee structure of these leading cryptocurrencies.

The surge in Bitcoin’s transaction fees reached a six-month high on November 16, hitting $18.67, while Ethereum’s fees were comparatively lower at $7.90. This increase in Bitcoin fees seems to be correlated with the rising interest in assets inscribed with the Ordinals Protocol. This tool enables the creation of NFT-like assets and BRC-20 tokens directly on the Bitcoin blockchain.

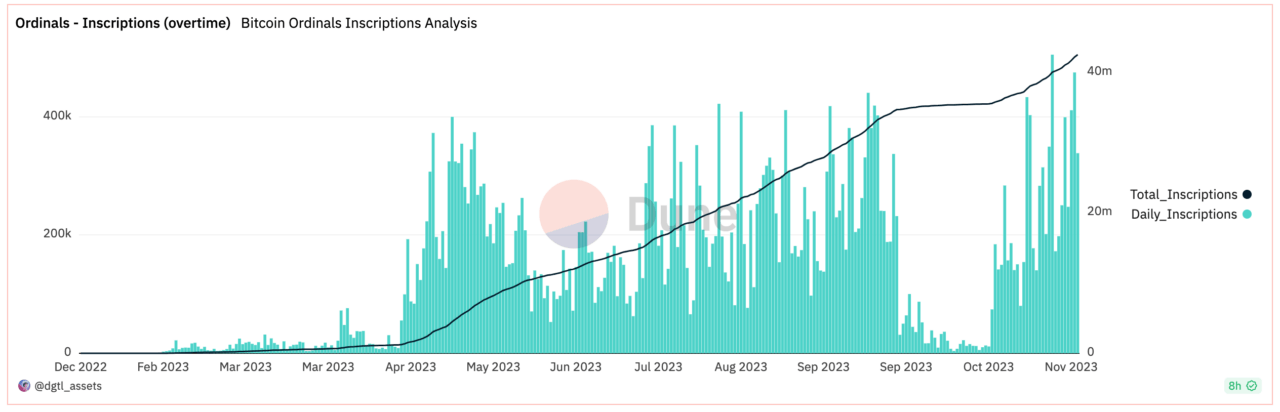

According to a report by Cointelegraph, a notable increase in the creation of Ordinals-based assets was observed starting in late October, following a period of reduced activity from September 25 to October 23. The report mentions that data from Dune Analytics indicates that since October 24, over 6 million Ordinal assets have been inscribed, generating more than 800 BTC in transaction fees, equivalent to approximately $30 million. These fees are redistributed within the Bitcoin network.

Featured Image via Pixabay

Source: Read Full Article