$MATIC Sees A Massive Spike In Whale Transactions Following META’S Announcement

Summary:

- MATIC’s price has gone up by 33% in the last month.

- Since Polygon announced that Meta had selected them for minting digital collectibles, MATIC has seen a surge in on-chain activity.

- A price/network growth divergence, usually followed by a price retracement, might be underway.

Following the confirmation of tech giant Meta’s decision to let its users mint and sell Polygon-enabled digital collectibles, MATIC reached a new on-chain milestone on 3 November, data from Santiment showed.

According to the on-chain data analytics platform, MATIC logged its highest daily count of whale transactions that exceeded $100,000 since February. A total of 302 $100k+ whale transactions were recorded.

The surge in transactions count on the network led to a corresponding rally in the price of the altcoin. As a result, per Santiment, MATIC saw an intraday trading rally of 15% on 3 November. Still, in an uptrend at press time, data from CoinMarketCap showed that the price of the 11th-ranked cryptocurrency asset was up by 20% in the last 24 hours. Moreover, its trading volume increased by over 65% within the same period.

October to remember

The last month was marked by a series of significant ecosystem development for the layer 2 blockchain. Within the 31-day period, Polygon saw integrations with leading blockchain protocols and entered into new partnerships with other leading projects.

What Happened to the @0xPolygon Ecosystem in October 👀

Let’s take a look at the highlights of this month’s events 👇 pic.twitter.com/OHIpcSQ3RT

— Polygon Daily 💜 (@PolygonDaily) November 2, 2022

In addition to this, the number of unique addresses on the network crossed 13 million, putting it ahead of Ethereum, which registered 6.8 million unique addresses in October.

The Growth of the Number of Unique Addresses in October 2022 🚀🚀@ethereum X @BNBCHAIN X @0xPolygon #Polygon +13.2M#BNBChain +14.8M#Ethereum +6.8M pic.twitter.com/IufuaTmUis

— Polygon Daily 💜 (@PolygonDaily) November 2, 2022

All you must know

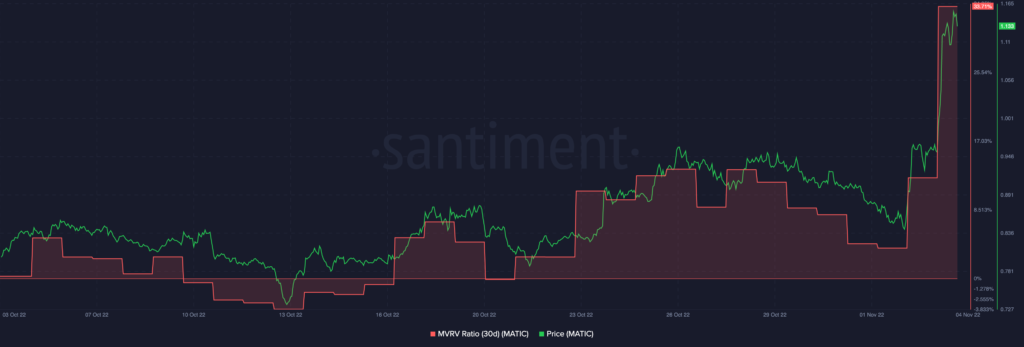

As of this writing, MATIC sold for $1.13. In the last month, the price per MATIC went up by 33%. This led to a rally in its MVRV ratio on a 30-day moving average, thereby causing its holders to see profits on their MATIC holdings. According to data from Santiment, MATIC’s MVRV ratio on a 30-day moving average was 33.17%. This meant that if all MATIC holders sold their coins at the current price, they would record double profits on their investments.

Also, as MATIC’s price climbed in the last month, its supply on exchanges declined as well. This indicated that fewer MATIC sell-offs had taken place in the last month, and that investors remained confident that the alt’s price would continue to rise.

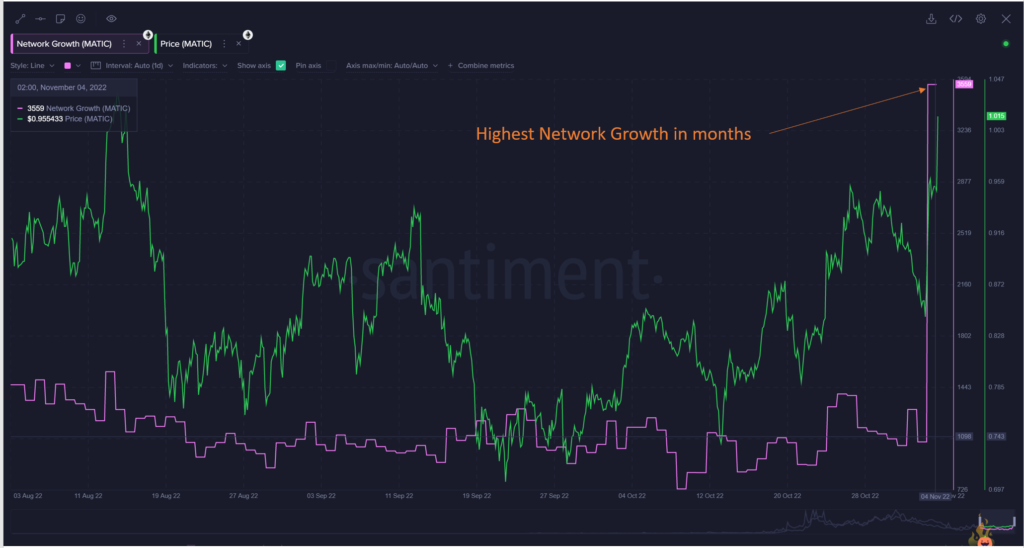

Lastly, yesterday’s rally in price led to a surge in the count of new addresses on MATIC’s network. According to Santiment, the daily count of new addresses on the network yesterday was 3559. It is pertinent to note that a decline in this metric and continued growth in price would hint at the formation of a divergence. This usually indicates that a local top has been reached and new buyers are no longer coming in.

Source: Read Full Article