Short-term Treasury yields crash

Money flooded into U.S. government bonds on Monday after the collapse ofSVB and Signature Bank.

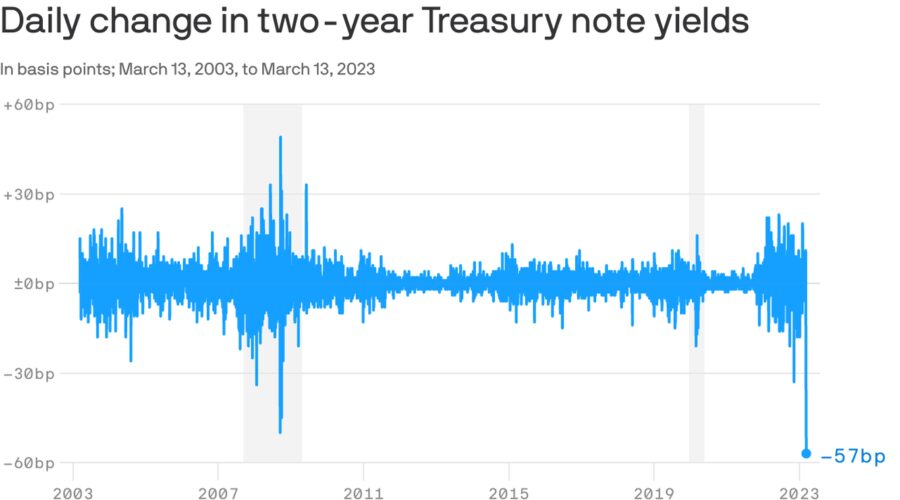

What happened: The yield on the two-year U.S. Treasury note plunged by more than half a percentage point (bond yields go down as prices go up).

- That may not sound like much — but in the world of government bonds, moves of this magnitude are incredibly rare.

- The last time we saw a one-day move this large was on Sept. 17, 2001, when markets first reopened — and then tumbled — after the Sept. 11 terrorist attacks.

- Besides that, the only day that comes close is Oct. 21, 1987, in the aftermath of the stock market crash.

What it means: It's hard to say exactly — there are a lot of competing motivators at play.

- Clearly, ongoing worries about the banking system give people plenty of reason to park some cash in Treasuries, a traditional port of call for investors during panicky periods.

- The plunge also likely reflects expectations that the banking crisis that broke out over the last few days might mean the Fed's rate-hiking days are numbered.

- Finally, some of the move may be driven by investors unwinding complex trades that have been upended by the market turmoil.

Source: Read Full Article