Despite IRS pause, Americans getting 1099-Ks from payment network providers

IRS to begin sending 1099-K forms for some payments

Sen. Mike Braun, R-Ind., explains the details regarding the IRS starting to send out 1099-K forms for some payments on ‘Fox Business Tonight.’

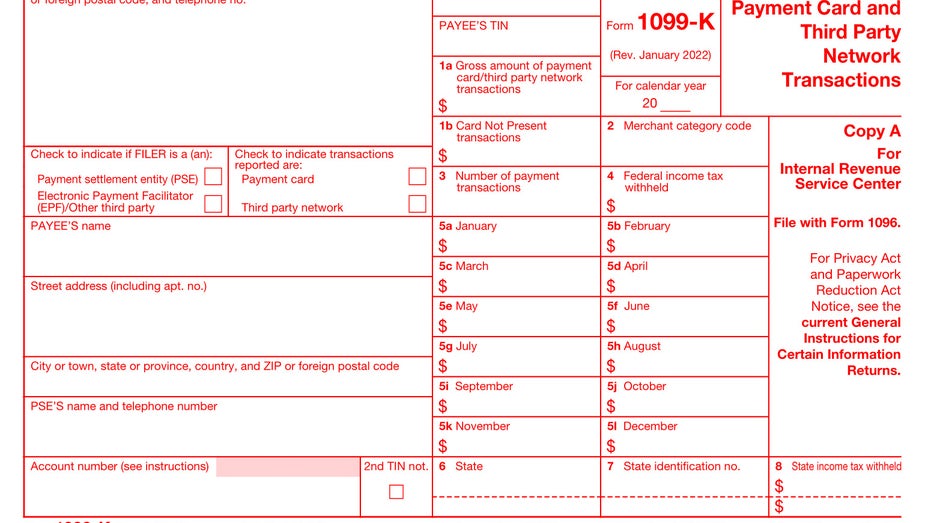

Some Americans are finding a surprise tax form in the mail. It is Form 1099-K, the document sent by third-party network providers including eBay, PayPal and Venmo to report transactions made with debit, credit, or stored-value cards.

The American Rescue Plan lowered the dollar threshold under which a payment network had to send a 1099-K to $600 from $20,000 and lowered the minimum number of transactions to one from 200.

The change was widely criticized. The IRS delayed the requirement until next year, but some taxpayers are still getting the form now.

More than two-thirds of 1099-Ks entered this year into one tax preparation website fell under the $20,000 / 200 transaction thresholds, according to an employee posting.

Venmo, eBay and PayPal all confirmed to FOX Business that they do not send Form 1099-Ks unless required by law. So why are some people below the IRS filing threshold getting a form?

Tax experts speculate some smaller companies may have been unwilling or unable to adjust their systems to comply with the IRS end of the year change and decided to send out forms since there is no penalty for sending a Form 1099-K when it is not required.

"I predicted such an occurrence in interviews I gave after the IRS provided the one-year delay on December 23, 2022," said Tom O'Saben, the National Association of Tax Professionals director of Tax Content & Government Relations. "In my opinion, third-party settlement agencies likely had the infrastructure in place to comply with the reduced threshold rules and decided to follow those guidelines as general business practice immediately, rather than wait until next year."

SMALL BUSINESSES FIND RISKY TAX LOOPHOLE TO DODGE NEW IRS RULES

Three reasons

IRS Form 1099-K Andy Phillips, director of the Tax Institute at H&R Block said some Americans may be receiving a Form 1099-K because they live in states with tougher rules. "In addition, some platforms may still voluntarily issue a Form 1099-K to taxpayers even if they do not meet the higher threshold. Lastly, a Form 1099-K would be issued if the platform withheld any income tax during the year," Phillips said. IRS UPDATES GUIDANCE ON 1099-KS: WHAT TO KNOW Shot of a young couple looking anxious while doing their budget at home. O’Saben works with an Illinois firm that prepares thousands of tax returns every year. He said 1-2% of clients have come in with a Form 1099-K, though it is early in the tax season. The form is new to many and requires taxpayers to input purchase prices, which they may not have on hand. "When we encounter those who are in receipt of these forms, we are forced to ask the question as to why they received it. There is no default treatment for receipt of Form 1099K," O’Saben said. The IRS considers all income taxable. They will want to see a Form 1099-K on your return. However, you do not pay tax unless you make a profit. "When someone has a taxable gain on a garage sale, income from gig work, or any other type of income, they need to report it on their tax return even if they do not receive a Form 1099-K or other 1099 for the income," explained Phillips. "If you get it in error, you include it in income. Make a note that it's a 1099-K received in error, and then you deduct it as an adjustment," said tax practitioner Ryan Ellis, president of the Center for a Free Economy, a group that lobbied for maintaining the $20,000 / 200 transaction reporting requirements. IRS TO BEGIN SENDING 1099-K FORMS FOR SOME PAYMENTS In December, the IRS issued an FAQ to help taxpayers tackle Form 1099-K. A couple calculating financial bills at home. Online payment platform Stripe listed five states and the District of Columbia with $600 thresholds: Rhode Island has a $100 threshold; Illinois and New Jersey have a $1,000 bar; and Arkansas’s line is $2,500. GET FOX BUSINESS ON THE GO BY CLICKING HERE Source: Read Full ArticleNo default treatment

Lower state thresholds