Top Decentralized Platforms (DEX) for Crypto Trading

Decentralized platforms for trading are extremely popular in the crypto market, and for a good reason. These are, first and foremost, non-custodial, meaning that you are always in control of your funds. You’ll also find a much larger selection of crypto assets — and you can trade these for lower fees. Decentralized Exchanges (DEXs) have been growing in popularity for these reasons and more, and many new DEXs arrive on the market with regularity.

While there are many established DEXs that have taken the market by storm, there are also many flying under the radar. We won’t be delving into the major DEXs here. Instead, we’ll focus on the lesser-known ones that might catch your attention.

Top 6 DEXs for Trading

1. GMX

The GMX DEX is one that has been making a lot of noise in the crypto market in recent months. Initially launched on the Binance Smart Chain, the team has shifted its operations to the Arbitrum network, and it also works on Avalanche. This makes it one of the first perpetual contract exchanges on Arbitrum, and this has partly been why it has been so popular.

Users can take leverages up to 30x, and they borrow funds from the multi-asset liquidity pool that it has to offer. The Chainlink oracle powers the prices. Swap fees are 0.33%, while fees to open or close a position are 0.1%. The project has two tokens: GMX and GLP. The former is a utility and governance token, while the latter is a representation of the index of assets in the trading pool.

GMX REFERRAL LINK : For fee discounts register with the following link.

2. dYdX

dYdX is the one most well-known of DEXs on this list. Founded in 2017, it also offers perpetual contracts trading. Specifically, it offers cross-margin perpetual trading, which means that users can rework their balance on the platform to provide liquidity. This helps avoid liquidations in times of high volatility.

The DEX has also moved into the NFT space, launching its own NFT collection called “Hedgies.” The token used on the platform is DYDX, which is a governance token that they earn for their activities on the DEX. Users can also stake their crypto assets to earn the DYDX token.

DYDX Referral Link: Use the following link to get 5% Discount on all Trading Fees

3. WOO Network

Created by Kronos Research, WOO Network is a platform that offers both centralized and decentralized exchanges. Its DEX is WOOFi, which also offers staking services. WOO Network aggregates liquidity from several DeFi networks. Market makers can also use the platform to hedge exposure.

WOOFi is built on the Binance Smart Chain and uses a Synthetic Proactive Market Making Protocol to determine prices. Users can stake their assets to earn a share of the revenue generated from swapping on the platform. They also engage in yield farming services. The WOO is a utility token that can be used for governance, staking, providing liquidity, and much more.

WOO Network Referral Link: Use the following linkfor zero-fee trading.

4. Kwenta

The Kwenta crypto exchange is based on the Synthetix protocol. The primary purpose of the DEX is to trade synthetic derivatives. Users can trade a synthetic asset against another instantly. It also allows them to work with other financial instruments. Users deposit the assets that they have and can exchange them for synthetic ones, and it also offers synthetic derivatives of the U.S. dollar, euro, and Japanese yen.

There is no trading slippage on the platform, which is one big benefit. The liquidity itself is derived from SNX stakers on Synthetix. It offers up to 10x leverage.

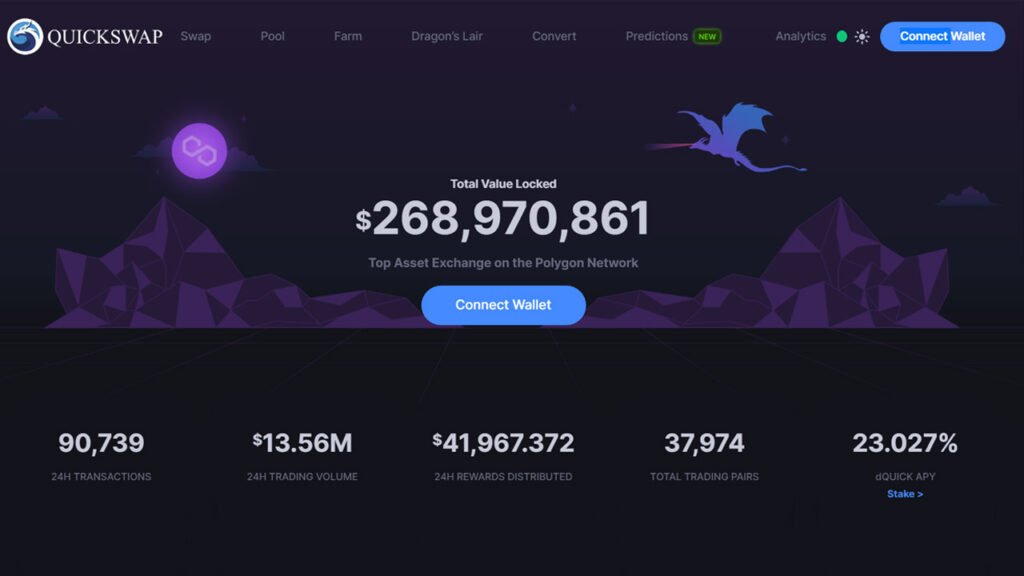

5. QuickSwap

QuickSwap is a DEX built on the Polygon Network. It works similarly to most DEXs in that it offers trading, staking, farming, and liquidity provision. It also offers a bridge between Ethereum and Polygon.

One of the key features of QuickSwap is the Dragon’s Lair, which is a long-term staking provision that eliminates losses from impermanent loss. The native token of the DEX is QUICK, and this can be staked in the Dragon Syrup Pools. QUICK can be used for yield farming, liquidity provision, staking, participating in Initial DEX Offerings (IDOs), and more.

6. KLAYswap

KLAYSwap is a decentralized protocol built on the KLAYTN network. The AMM protocol has a particular focus on having large liquidity, and it provides instant swaps for users. The team has said that the protocol is intended to help bring the wider public into the DeFi ecosystem. You can transfer Ethereum-based tokens to KLAYSwap via the Orbit Bridge, built on the Orbit Chain.

While the platform is not as popular as some of the other DEXs, there has been some talk about its design and use. The native token of the platform is KSP, which can be used for governance. Holders of KSP can also receive a share of the revenue from transaction fees. KSP can also be mined.

Decentralized Exchanges Have Benefits

If you are someone who values privacy and wants full control of your funds, and if you want your transactions to be more private, then DEXs are for you. There is no shortage when it comes to selecting a particular exchange, as our list above shows.

Choose the DEX based on the features you’d like and the particular benefits they offer. Try them out a few times and get a sense of the experience. You’re guaranteed to find a platform that you want to stick with. The DEXs we listed here will give you a good insight into lesser-known DEXs, and you may find yourself finding a go-to platform.

Source: Read Full Article