NVIDIA's Market Lead and Future in AI Chips: Insights by Bernstein Analyst

Yesterday, on CNBC’s “Closing Bell Overtime”, AB Bernstein analyst Stacy Rasgon provided an insightful analysis of NVIDIA’s current market position and its future in the AI chip industry. Rasgon highlighted NVIDIA’s significant lead over competitors and discussed the company’s valuation and investment potential. He is the Managing Director and Senior Analyst for U.S. Semiconductors and Semiconductor Capital Equipment at Bernstein Research.

As you might already know, earlier that day, NVIDIA Corp. (NASDAQ: NVDA) unveiled its H200 Tensor Core GPU, which it calls “the world’s most powerful GPU for supercharging AI and HPC workloads.”

According to a report by CNBC, this GPU marks a substantial improvement over the H100, which played a crucial role in training OpenAI’s GPT-4.

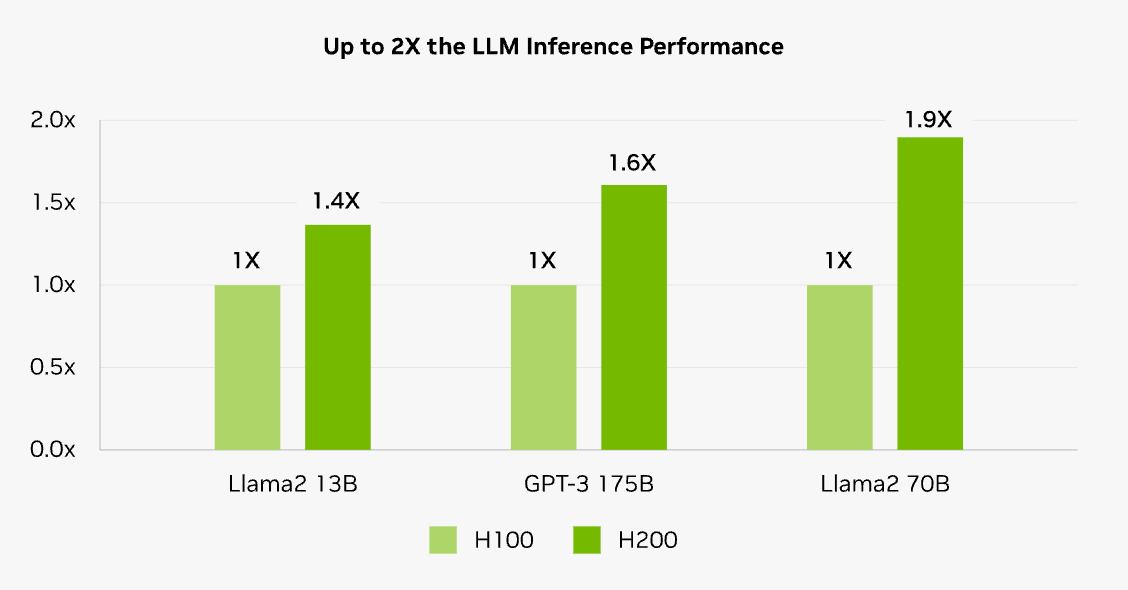

The H200 stands out with its 141GB of cutting-edge “HBM3” memory, significantly boosting its capacity for “inference” – the application of trained AI models in generating outputs like text and images. In tests, it has shown to produce results nearly twice as fast as the H100.

Scheduled for release in the second quarter of 2024, the H200 will compete with AMD’s MI300X GPU. Both are designed with extra memory to better handle large AI models. Notably, the H200 is backward compatible with the H100, allowing for seamless integration into existing AI infrastructures.

Nvidia’s H200 will be available in multiple configurations, including a version that combines the H200 GPU with an Arm-based processor. Despite these advancements, Nvidia is already planning future developments, indicating a shift to a yearly release cycle to meet the growing demand for its GPUs. This strategy points to the potential launch of the B100 chip, based on the new Blackwell architecture, in 2024.

Now, going back to Rasgon’s interview on CNBC yesterday, Rasgon emphasized NVIDIA’s dominant position in the AI chip market. He noted that while competitors like AMD, Intel, and potentially Microsoft are striving to catch up, NVIDIA continues to advance, constantly moving the goalposts further. He pointed out NVIDIA’s accelerated progression, citing the upcoming launch of their next-generation architecture, Blackwell, in the second half of the next year. According to Rasgon, even if competitors reach NVIDIA’s current level, NVIDIA will have already advanced further, making it challenging for others to truly catch up.

Despite NVIDIA’s high stock price, Rasgon argued that the company is relatively undervalued, especially when compared to competitors like AMD. He mentioned that on a valuation basis, NVIDIA’s stock is cheaper than it has been for a long time, potentially even more so than AMD.

Rasgon provided context by comparing NVIDIA’s and AMD’s expected AI sales, noting that if NVIDIA were to make only $50 billion in data sales next year, it would be a disappointment, indicating expectations of even higher sales.Future Outlook and Sustainability:

Rasgon acknowledged the rapid growth in NVIDIA’s earnings, which has led to a decrease in the stock’s relative price. He expressed caution about the sustainability of NVIDIA’s rapid growth, suggesting that encountering future challenges is almost certain, based on past patterns. However, looking at a longer-term perspective, Rasgon seemed optimistic about NVIDIA’s prospects, indicating a belief in the company’s continued growth over the next five to ten years.

https://youtube.com/watch?v=Gq8T6wwGZIE%3Ffeature%3Doembed

Featured Image via NVIDIA

Source: Read Full Article