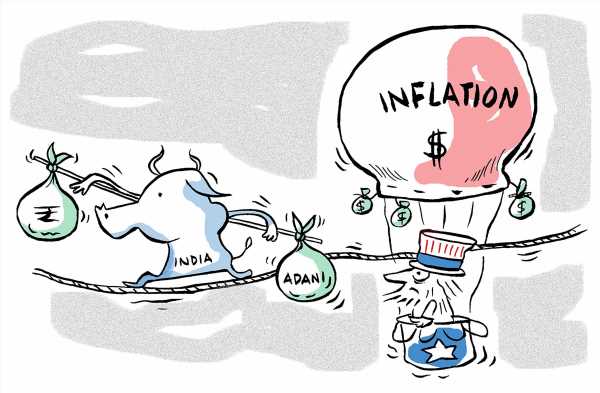

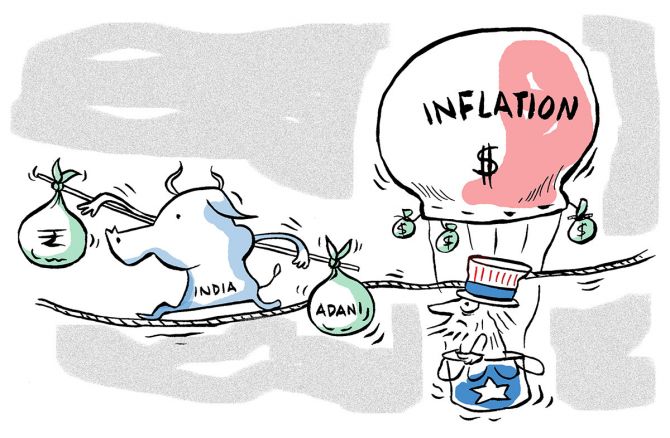

‘If BJP Is Not Re-Elected, Foreign Investors May Sell’

‘The biggest risk to the Indian markets from a 12-18-month view is that the current government does not get re-elected, or loses in a way that is not represented at all in the next central government.’

Christopher Wood, global head of equity strategy at Jefferies, tells Puneet Wadhwa/Business Standard about his strategy for the Indian markets. The concluding segment of a two-part interview:

- Part 1 of the Interview: ‘The group has quality physical assets’

The next 12 months remain crucial for the Indian political landscape given the state elections and then the general elections. How will you be approaching the Indian equity markets in this backdrop?

Right now, I would not be too worried about it and would not let it influence my decisions regarding my Indian holdings/portfolio.

The elections are still one year away. The general elections in India will be a practical issue for the stock market five months ahead of the event.

Though the Bharatiya Janata Party lost in Karnataka, the consensus view here suggests that the electorate votes differently in state and general elections.

That said, Karnataka has never re-elected an incumbent government.

The base case for foreign investors now is that the government will get re-elected next year. If that does not happen, it will trigger selling.

Would you then be trimming your exposure to India?

Well, I would need to see the outcome first. It is too early to worry about all this right now.

What are the key risks for the Indian markets?

By a long way, the biggest risk to the Indian markets from a 12-18-month view is that the current government does not get re-elected, or loses in a way that is not represented at all in the next central government.

This will be viewed negatively by foreign investors, and there is no doubt about it.

What’s your sector preference in the Indian context, besides your bullishness towards banks?

Our main holding remains banking stocks.

Another sector that the investors should look to add now is property.

We’re in the third year of an upturn in the residential property prices.

The upturn usually lasts 7 years. These stocks can rally in case of monetary easing.

The capex-related plays also look good. In the short-term, the discretionary consumption stocks can be under pressure.

Information technology stocks are relatively cheap now due to a fall earlier on US recession fears.

In case the US does see a recession, there should be no hurry to buy IT stocks.

Then we have idiosyncratic plays, such as the electric vehicle-focused plays, e-commerce areas where the valuations are no longer expensive.

You are here in India after a year. What are the key changes you see? What are the key takeaways from the Jefferies Annual India Forum?

The key takeaway is that the Indian economy has recovered from the trauma of the Covid pandemic.

So, the initial reaction to the pandemic was economically disastrous.

A prolonged lockdown would have caused a massive deterioration in asset quality.

The pleasant surprise for me is that the consumer finance companies weathered the storm well.

The overall impact of the Covid pandemic on the Indian economy was not severe.

Though the Indian government distributed food, they avoided the temptation of distributing free money like the West, which caused the inflation problem.

So, what was the bad/not so good part?

For me, the bad part was that the Indian market did not correct more.

I could have added more stocks in that case.

This time last year, the RBI was a bit behind the curve. They seem to be doing okay now.

I think there was pressure from the central government then. There could have been some serious pressure on the currency.

Do you think that there is a mismatch between the Indian markets and the economic fundamentals?

No, I don’t think so. The Indian markets and the economy are well-balanced.

The Indian markets and the economy are more balanced now than they were a year ago.

A Jefferies report suggested that India Inc may be on the cusp of a revival in the capex cycle. Another report argued that capex plans may get derailed as the country heads deeper into an election year. Can you provide some clarity?

There can be some populist measures, but there is definitely a lack of them right now.

One interesting thing about the Indian Budget in February was the complete lack of populism.

So, the government’s deficit is primarily being driven by infrastructure spending.

The gross fixed capital formation has been declining versus GDP.

Hence, we see the order books of infrastructure-related and industrial companies rising.

The corporate sector is also getting deleveraged. All the readings are for a capex cycle.

How are things looking globally? Are the financial markets over with their fears regarding a possible recession?

No, they are not. The equity markets are behaving like there will be a recession in the US.

The debt ceiling issue has seen some developments in the bond markets in the US.

The money markets are still expecting rate cuts before the year ends.

The yield curve has been inverted for a long time now in the US.

So, while the money and bond markets are signaling a US recession, the stock markets are expecting the opposite.

All signals are confusing. But one has to remember that the rally in the S&P 500 has been driven by a handful of stocks.

Ever since Chat GPT came around, it has taken up many consumer applications, there is no doubt that the artificial intelligence’s growth story has been driving the handful of stocks in the US.

Do you expect more skeletons to fall out of the US’ and Europe’s banking closet? And can the contagion spread to the other regions?

No, this is a domestic, US-related issue.

Though the contagion can spread, it is more of a US-related problem.

More than the US banking issue, it is a US regional banking issue.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Feature Presentation: Rajesh Alva/Rediff.com

Source: Read Full Article