Former FTX CEO Sam Bankman-Fried Tried To Raise Cash After Chapter 11 Filing: WSJ

Users and analysts who dug into FTX’s books after a CoinDesk report believe Bankman-Fried used customers’ funds to back Alameda, his quantitative trading firm with intrinsic ties to the troubled crypto exchange.

It’s unclear how much of user assets were used to prop up Alameda but the aftermath resulted in a massive $8 billion hole in the exchange’s balance sheet. The liquidity crisis was mentioned by Changpeng Zhao as the main reason Binance chose not to buy FTX after both exchange heads announced an agreement.

Notably, SBF made a similar “last ditched effort” to get cash from silicon valley investors on the same day the Binance deal was revealed. Reports suggest that Bankman-Fried did not succeed on both occasions.

FTX Bankrupt

The news comes after FTX filed for bankruptcy and SBF resigned as CEO on November 11. Further filings made at the Delaware District Court also revealed that more than 1 million creditors may lay claim to assets during the proceedings.

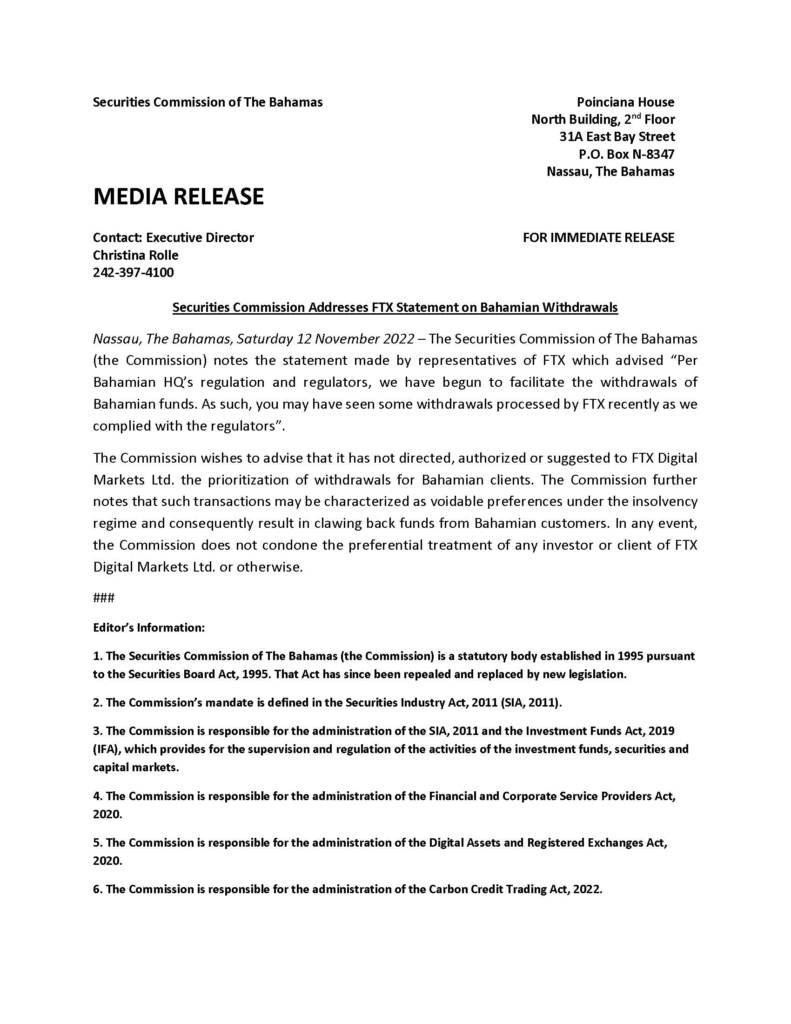

Bahamian regulators also debunked rumors that authorities ordered the exchange to process withdrawals for local users and accounts. The Securities Commission was forced to issue the statement after the crypto exchange claimed that withdrawals were reopened based on a directive from the financial watchdog.

1) Per our Bahamian HQ's regulation and regulators, we have begun to facilitate withdrawals of Bahamian funds. As such, you may have seen some withdrawals processed by FTX recently as we complied with the regulators.

Source: Read Full Article